Revealed: Art Deco homes are the most prone to burglary

Did you know the style of your home impacts your chance of theft? Find out where your home sits in the rankings...

Get small space home decor ideas, celeb inspiration, DIY tips and more, straight to your inbox!

You are now subscribed

Your newsletter sign-up was successful

It had never occurred to us that the era in which our homes were built might affect the chance of them being burgled. But the stats reveal that it does, and to quite a large degree.

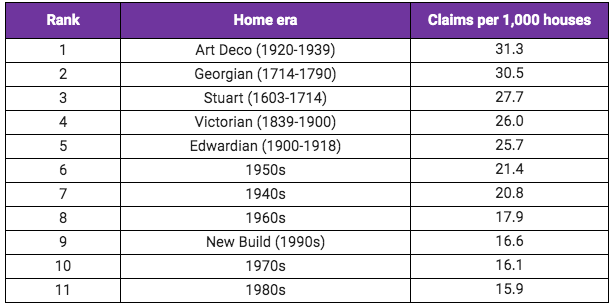

New research from MoneySuperMarket reveals that Art Deco homes (built between 1920 and 1939) have almost double the amount of insurance claims per 1,000 houses in comparison with houses built in the 1980s. Isn’t that shocking?

Whether it’s the large flat windows, experimental shapes or curved walls, something about Art Deco homes is attractive to burglars. Closely followed in the ranks by the grandeur of Georgian homes, it seems these elegant styles are suggestive of wealth, and may leave you more at risk than homes from other periods.

Here's the results from all the property styles studied, where does yours sit in the rankings?

- Best video doorbells: see who's at the front door, even from your holiday sun lounger

Burglary rate per era:

The research looked at 1.5 million home insurance enquiries between February 2018 and January 2019. They found the greatest number of 1930s houses are found in Birmingham, followed by Harrow and Manchester.

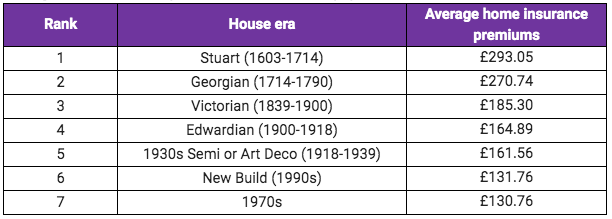

There are many factors that impact the price you pay for home insurance, including the condition of the building, the location, and also the age of the house. Surprisingly, 30 per cent of us don’t know when our homes were built, meaning we could be paying the wrong amount for our insurance. If you know when yours was built, use this handy guide to see approximately how much you should be paying...

- Best outdoor floodlights: illuminate your home at night

Average home insurance premiums for homes from popular eras:

Helen Chambers, head of home insurance at MoneySuperMarket, comments, 'To help reduce the risk of burglary, we recommend investing in security measures such as alarms or CCTV. While there is an initial cost to this, not only will it decrease the likelihood of theft, but it can also help to lower the cost of your insurance.

Get small space home decor ideas, celeb inspiration, DIY tips and more, straight to your inbox!

'When searching for home insurance, the most important thing is to ensure you answer all questions to the best of your knowledge, so you can get an accurate quote and the best deal available for your needs. We’d also recommend shopping around before renewing, as 51 per cent of us could save up to 43 per cent on home insurance.'

- Best home security systems: keeping an eye on your home, indoors and out

Do you know which period your home is from? Find out how old your home is with our guide.

More on home security:

After joining Real Homes as content producer in 2016, Amelia has taken on several different roles and is now content editor. She specializes in style and decorating features and loves nothing more than finding the most beautiful new furniture, fabrics and accessories and sharing them with our readers. As a newbie London renter, Amelia’s loving exploring the big city and mooching around vintage markets to kit out her new home.